A Defined Contribution Plan is a type of retirement plan that allows employees to invest pre-tax dollars in the capital markets, where they can grow tax-deferred until retirement . In a defined contribution plan, employees contribute a fixed amount or a percentage of their paychecks to an account that is intended to fund their retirements. The sponsor company can match a portion of employee contributions as an added benefit . These plans place restrictions that control when and how each employee can withdraw from these accounts without penalties .

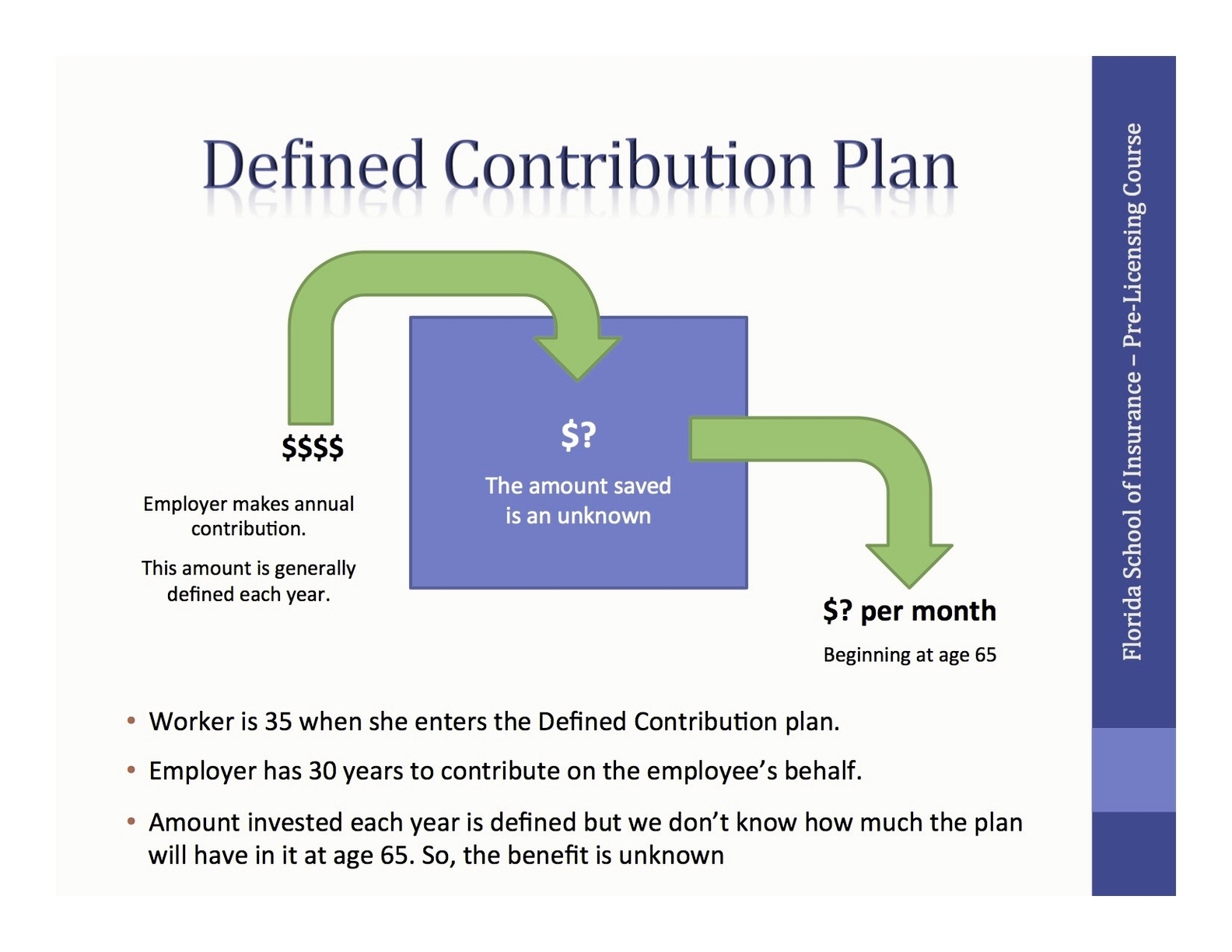

Defined contribution plans can be contrasted with defined benefit (DB) pensions, in which an employer guarantees retirement income. There are no guarantees with a DC plan, and participation is voluntary and self-directed . There is no way to know how much a DC plan will ultimately give the employee upon retiring, as contribution levels can change, and the returns on the investments may go up and down over the years .

DC plans accounted for $11 trillion of the $34.2 trillion in total retirement plan assets held in the United States as of Dec. 31, 2021, according to the Investment Company Institute (ICI) . The tax-advantaged status of DC plans generally allows balances to grow larger over time compared to accounts that are taxed every year, such as the income on investments held in brokerage accounts . Contributions made to a DC plan may be tax-deferred until withdrawals are made. In the Roth 401(k), the account holder makes contributions after taxes, but withdrawals are tax-free if certain qualifications are met .

In summary, a defined contribution plan is a retirement plan that allows employees to invest pre-tax dollars in the capital markets, where they can grow tax-deferred until retirement. It is a self-directed plan, and there are no guarantees with a DC plan. The tax-advantaged status of DC plans generally allows balances to grow larger over time compared to accounts that are taxed every year, such as the income on investments held in brokerage accounts ..