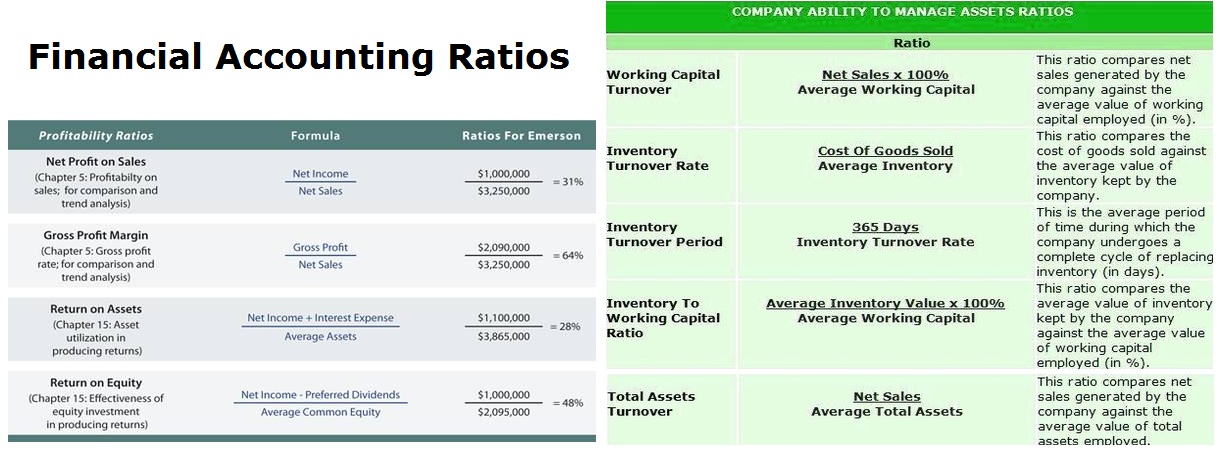

Accounting Ratios are used to evaluate company’s performance and relevant standing against its competitors. The list of the key accounting ratios includes profit margin, gross margin, asset turnover ratio, current ratio, quick ratio and other ratios.

Financial accounting ratios help analyze how a company is performing in any given year and through out the years. Balance sheet shows the financial position of a company at a given point in time. Income statement shows financial performance through a given time period, e.g. a year. Cashflow statement depicts the flow of cash through a given time period. Accounting ratios help connect the statements together and make sense of what is happening with the business.